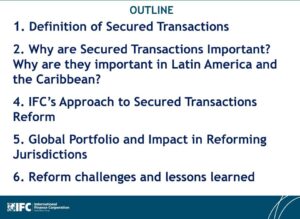

Secured Transactions Important

A secured transaction is a type of contract where the buyer or borrower pledges collateral as a guarantee of repayment. This collateral may be tangible goods, intangibles, or fixtures. The laws governing secured transactions are very different than those governing non-secured transactions. If the buyer or borrower fails to pay, the lender can sell the collateral and recoup its value.

The law of secured transactions varies from state to state. Although each state has its own set of rules, the Uniform Commercial Code Article 9 covers secured transactions in detail. This article applies to any transaction security creating a security interest, including the sale of chattel papers, accounts, and other items. It also governs the general structure of the relationship between the borrower and lender.

Secured transactions are an integral part of the business world and play a crucial role in bankruptcy proceedings. They are a vital part of the bankruptcy process because they provide the creditor with a way to obtain money from the borrower when the latter fails to pay. The security interest grants the creditor superior bargaining power and allows the creditor to maximize their chances of receiving payment.

Unlike unsecured loans, secured transactions are more protected for the lender and impose a greater risk on the borrower. It is important for debtors and creditors to understand how these contracts work. An experienced Orange County Business Law Attorney can help by providing information on secured transactions and reviewing loan documents. It is important to understand the different types of loan documents to protect your interests.

Why Are Secured Transactions Important?

Secured transactions enable businesses and consumers to purchase tangible goods on credit. Without them, credit wouldn’t exist. Similarly, without secured transaction codes, tribal businesses would not be able to finance business-related equipment outside their jurisdiction. This way, tribal businesses can purchase the goods they need. And it is possible that they could even sell the items and retain a portion of the sale proceeds.

Despite the importance of secured transactions, the concept is often confusing. However, if you study properly and know how secure transactions work, you will be able to answer questions accurately. In addition to avoiding the pitfalls of secured transactions, you’ll also feel more confident and prepared for the exam. By studying properly and knowing the terminology involved, you can maximize your chances of scoring well on the MEE.

A blockchain wallet is a program linked to the blockchain. This program keeps track of the crypto and facilitates transactions. It uses a special cryptographic method to secure transactions. The wallets use a pair of keys, a public key and a private key. The public key is shared to receive funds, while the private key is kept secret. The private key authorizes the spending of the funds received by the public key.

Secured transactions are important to the smooth flow of commerce. However, they can also be confusing and intimidating. Fortunately, a qualified business law attorney can help you navigate the nuances of these contracts. Contact David, Brody & Dondershine, LLP for a consultation. We’ll be happy to discuss the details of your transaction and answer any questions you may have.